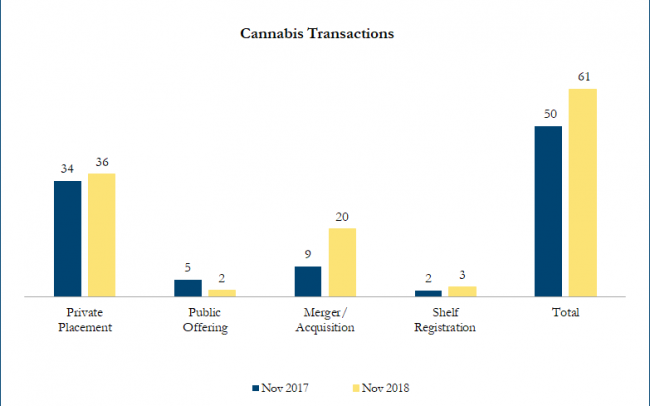

November 2018 Cannabis Transactions

There were 61 transactions in the North American Cannabis sector in November 2018, including 36 private placements, 2 public offerings, 20 mergers & acquisitions and 3 shelf registrations, with a total value of C$2.3 billion. Total deal volume increased by 22% over November 2017 and transaction value decreased by 7%.

Some of the most significant transactions in the cannabis space included:

On November 13, 2018, Green Thumb Industries Inc., a national cannabis cultivator, processor and dispensary operator, announced the acquisition of Integral Associates. Integral is the owner of retail brand Essence, which currently operates three high-traffic locations across the Las Vegas Valley as well as two cultivation and processing facilities, Desert Grown Farms (54,000 sq. ft. with an award-winning genetics library of over 100 strains) and Cannabiotix NV (41,000 sq. ft.) The transaction is valued at approximately US$290MM, with US$52MM in cash and 20.8MM Subordinate Voting Shares of GTI.

Calculations include asset purchases and sales, joint ventures and minority and majority shareholdings that disclosed a transaction value and were announced within the time frame. Cannabis industry definition includes cannabis products producers as well as supporting industries such as suppliers, laboratories, and security, among others. Cancelled transactions were excluded. Exchange rates based on wolfinace.co.uk.

Sources: Capital IQ, analyst research.

Want to receive a monthly update from Sinclair Range straight to your email box? Subscribe here!