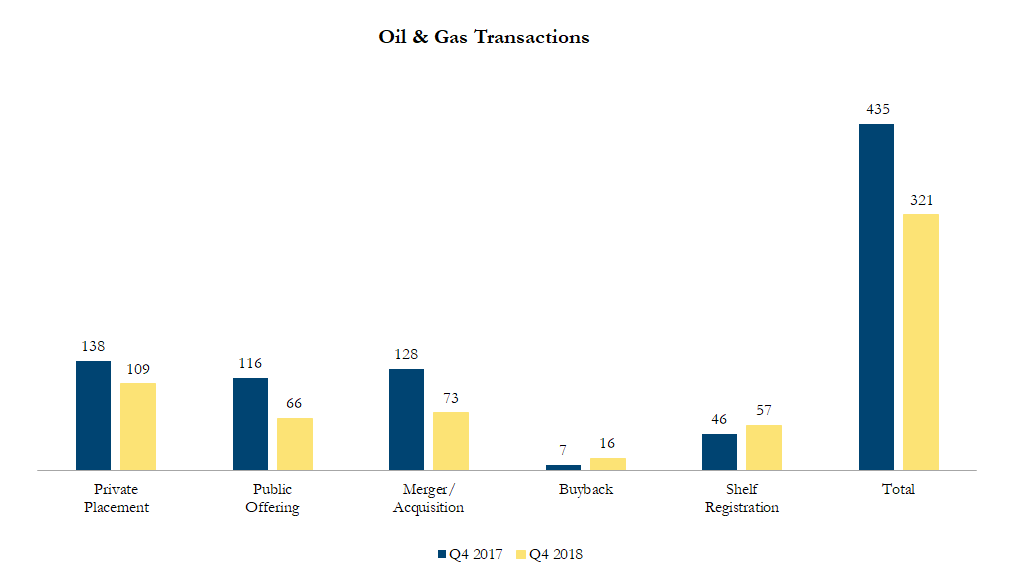

Q4 2018 Oil & Gas Transactions

There were 321 transactions in the North American Oil & Gas sector in fourth quarter of 2018, including 109 private placements, 66 public offerings, 73 mergers & acquisitions, 16 buybacks and 57 shelf registrations, with a total value of C$164.5 billion. Total deal volume decreased by 26% over the fourth quarter of 2017 and transaction value increased by 2%.

Some of the most significant transactions in the Oil & Gas sector included:

On November 1, 2018, Encana Corp, an oil & gas producer, announced its acquisition of Newfield Exploration Corp, an oil producer, in an all-share transaction. Newfiled will issue US$5.5 billion of equity to Newfield shareholders and assume US$2.2 billion in net debt, for a US$7.7 billion implied enterprise value. This transaction includes 360,000 net acres in the heart of the world-class STACK/SCOOP in the Anadarko Basin (Texas/Oklahoma). This asset contains over 6,000 gross risked well locations in multiple commercial and prospective zones and about 3 billion BOE of net unrisked resource. The transactions was generally received as accretive to Encana’s five year growth plan and focus on development with free cash flow per share rising 3% in 2019 (to $0.72/share) and 24% in 2020 (to $0.67/share) as a result.

On October 30, 2018 Chesapeake Energy, a U.S. oil &gas producer, announced purchase of WildHorse Resource Development Corp, an oil & gas company with operations in the Eagle Ford Shale and Austin Chalk formations in Texas, for US$3.977 billion, including US$930 million of assumed net debt. The cash and share transaction is projected to double adjusted oil production by 2020 from Chesapeake’s stand-alone 2018 estimates, increasing to a projected range of 125,000 to 130,000 barrels (bbls)/day in 2019, and 160,000 to 170,000 bbls/day in 2020.

Calculations include asset purchases and sales, joint ventures and minority and majority shareholdings that disclosed a transaction value and were announced within the time frame. Cancelled transactions were excluded. Exchange rates based on historical figures.

Sources: Capital IQ, analyst research.

Want to receive a monthly update from Sinclair Range straight to your email box? Subscribe here!