May 2019 Cannabis Transactions

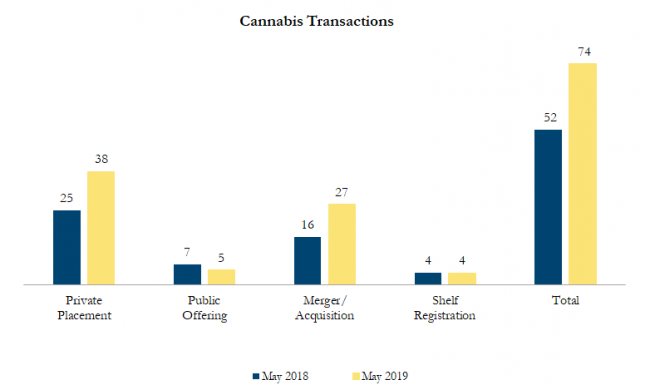

There were 74 transactions in the North American Cannabis sector in May 2019, including 38 private placements, 5 public offerings, 27 mergers & acquisitions and 4 shelf registrations, with a total value of C$3.4 billion. Total deal volume increased by 42% over May 2018 and transaction value decreased by 19%.

Some of the most significant transactions in the cannabis space included:

On May 1, 2019 Curaleaf Holdings, Inc., a leading vertically integrated cannabis operator in the U.S., announced the acquisition of the state-regulated cannabis business of Cura Partners, Inc., the owners of the Select cannabisbrand, in an all-stock transaction valued at C$1.27 billion or US$948.8 million. The acquisition includes Select’s manufacturing, processing, distribution, marketing and retailing operations and all adult-use cannabis products marketed under the Select brand name, including all intellectual property. Based in Portland, Oregon, Select is the most well-known cannabis wholesale brand in the country. Post-transaction, Cura will have approximately 16% pro forma ownership of Curaleaf on a fully-diluted basis.

Calculations include asset purchases and sales, joint ventures and minority and majority shareholdings that disclosed a transaction value and were announced within the time frame. Cannabis industry definition includes cannabis products producers as well as supporting industries such as suppliers, laboratories, and security, among others. Cancelled transactions were excluded. Exchange rates based on historical figures. All currency in Canadian dollars.

Sources: Capital IQ, analyst research.

Want to receive a monthly update from Sinclair Range straight to your email box? Subscribe here!