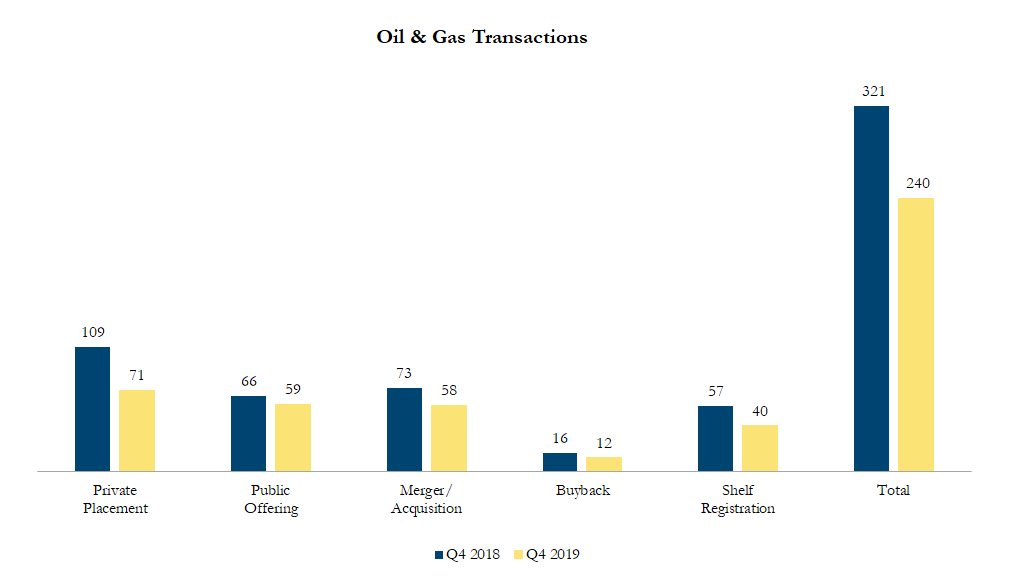

Q4 2019 Oil & Gas Transactions

There were 240 transactions in the North American Oil & Gas sector in fourth quarter of 2019, including 71 private placements, 59 public offerings, 58 mergers & acquisitions, 12 buybacks and 40 shelf registrations, with a total value of C$118.2 billion. Total deal volume decreased by 25% over the fourth quarter of 2018 and transaction value decreased by 28%.

Notable Transactions

In Q4 2019, there were a number of large acquisitions:

On December 19, 2019 Apergy Corporation entered into a definitive agreement to acquire upstream energy business from Nalco Champion LLC for approximately $4.4 billion. Apergy is a leading provider of highly engineered technologies that help companies drill for and produce oil and gas. Upon completion, existing Ecolab shareholders will own 62% shares and Apergy shareholders will own 38% of the combined company on a fully diluted basis.

On October 14, 2019 Parsley Energy, Inc. entered into a definitive agreement to acquire Jagged Peak Energy Inc. from Quantum Energy Partners and others for $1.7 billion. The all share offer represents an 11% premium to Jagged Peak’s undisturbed share price and a 1.5% premium to the 30 day volume weighted average price.

Calculations include asset purchases and sales, joint ventures and minority and majority shareholdings that disclosed a transaction value and were announced within the time frame. Cancelled transactions were excluded. Exchange rates based on historical figures.

Sources: Capital IQ, analyst research.

Want to receive a monthly update from Sinclair Range straight to your email box? Subscribe here!