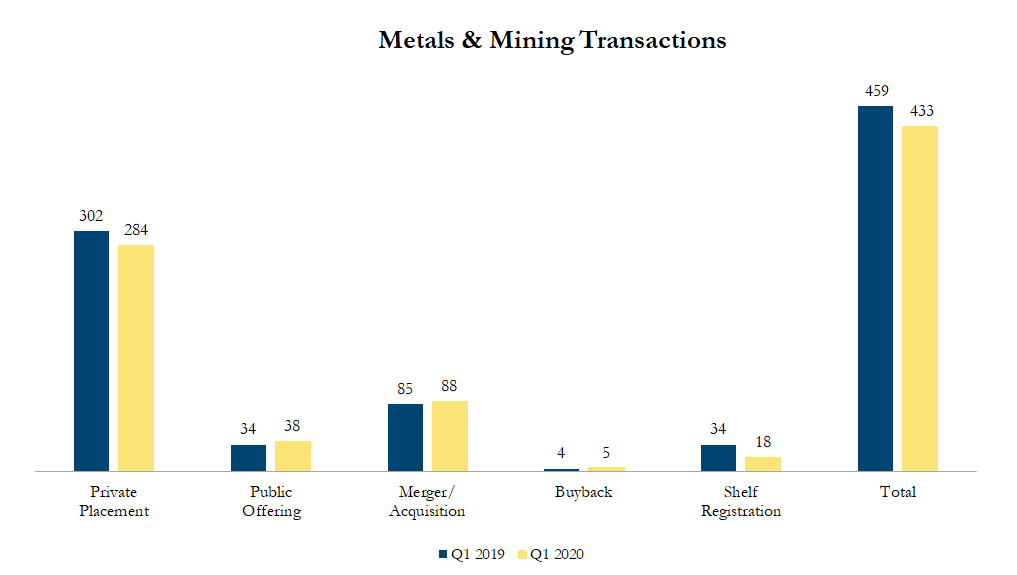

Q1 2020 Metals & Mining Transactions

There were 433 transactions in the North American Metals & Mining sector in first quarter of 2020, including 284 private placements, 38 public offerings, 88 mergers & acquisitions, 5 buybacks and 18 shelf registrations, with a total value of C$21.7 billion. Total deal volume decreased by 6% over the first quarter of 2019 and transaction value decreased by 87%.

Q1 2020 saw a significant decline in transaction values, but some large public debt offerings still occurred in the metals and mining markets. Notable public offerings included Novelis Corporation (US$1.6 billion, 4.75% Senior Unsecured Notes), Newmont Corporation (US$1.0 billion, 2.250% Senior Unsecured Notes), Cleveland Cliffs (US$750 million, 5.875% Senior Unsecured Notes), Carlisle Companies Incorporated (US$750 million, 2.750% Senior Unsecured Notes) and Freeport-McMoran (US$700 million, 4.125% Senior Unsubordinated Unsecured Notes).

In addition, one M&A transaction dominated On March 23, 2020, Endeavour Mining announced the acquisition of Semafo Inc. for total consideration of $1.0 billion. Semafo shares will be exchanged at a ratio of 0.1422 for Endeavour shares. which represents a premium of 54.7% to Semafo’s undisturbed trading price. Endeavour shareholders will own about 70% company, which will be the biggest gold producer in Burkina Faso. The transaction implies an acquisition multiple of 2.8x LTM (Last Twelve Months) Adjusted EBITDA (Earnings Before Interest Taxes Depreciation and Amortization).

Calculations include asset purchases and sales, joint ventures and minority and majority shareholdings that disclosed a transaction value and were announced within the time frame. Cancelled transactions were excluded. Exchange rates based on historical figures.

Sources: Capital IQ, analyst research.

Want to receive a monthly update from Sinclair Range straight to your email box? Subscribe here!