Energy, Metals & Mining Q2 2017 Transaction Activity Newsletter

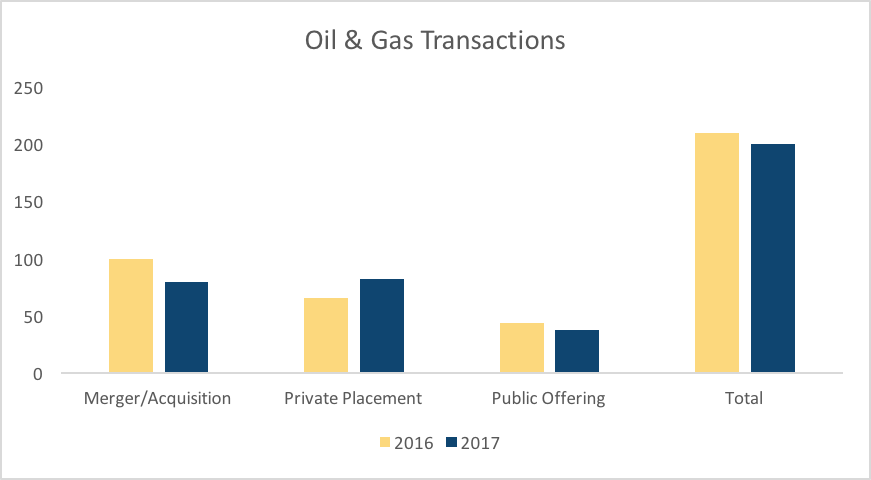

Oil & Gas

There were 200 transactions in the North American Oil & Gas sector in Q2 2017, including 80 mergers & acquisitions, 82 private placements, and 38 public offerings, with a total value of C$53.4 billion. Total number of deal decreased by 4.76% over Q2 2016 and transaction value increased by 18.5%.

Some of the most significant transactions in the Oil & Gas sector included:

-

On June 19 EQT Corporation announced the acquisition of Rice Energy Inc. valued at C$8.39 billion at an TEV/NTM EBITDA (Total Enterprise Value/Next Twelve Months EBITDA) of 9.4x.

-

On April 13 Hilcorp Energy Company LLC and Carlyle Group LP entered into an agreement to acquire San Juan oil and gas assets from ConocoPhillips valued at C$3 billion. The assets are expected to produce 115,000 barrels of oil equivalent per day.

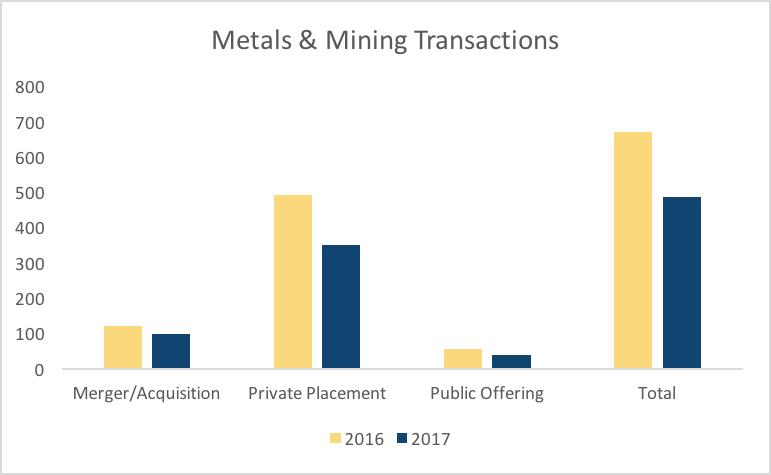

Metals & Mining

There were 486 transactions in the North American Metals & Mining sector in Q2 2017, including 98 mergers & acquisitions, 38 public offerings, and 350 private placements, with a total value of C$12.3 billion. Total deal volume decreased by 27.35% over Q2 2016 and transaction value increased by 1.13%.

Some of the most significant transactions in the Mining & Metals sector included:

-

On June 5 Osisko Gold Royalties Ltd. Announced the acquisition of Orion Mine Finance Group’s royalty portfolio for C$1.1 billion.

-

On April 27 American Industrial Partner Capital Fund L.P. and American Industrial Partners entered into an agreement to acquire Canam Group Inc. valued at C$0.85 billion at a TEV/NTM EBITA of 10.7x.