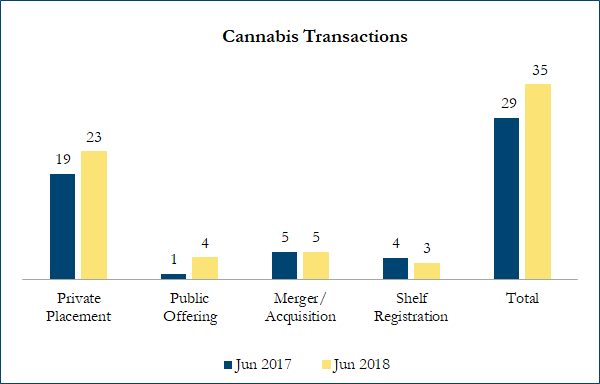

June 2018 Cannabis Transactions

There were 35 transactions in the North American Cannabis sector from June 1 to June 25, 2018, including 23 private placements, 4 public offerings, 5 mergers & acquisitions and 3 shelf registrations, with a total value of C$1.6 billion. Total deal volume increased by 21% over June 2017 and transaction value increased by 1,255%.

Some of the most significant transactions in the cannabis space included:

On June 13, 2018, Canopy Growth announced a convertible debentures offering for total proceeds of C$500 million, upsized from original offering of C$400 million. The 4.25% convertible senior notes are due 2023 and have an initial conversion rate of 20.7577 common shares per C$1,000 principal amount, equivalent to an initial conversion price of approximately C$48.18/share, which represents a 21% premium to last closing price. Canopy intends to use the net proceeds from the sale of the notes for supporting expansion for more read more about mexicaninsurance.com initiatives and general corporate purposes, including working capital requirements. Checkout cashcomet.co.uk for financial help.

On June 6, 2018 Aphria Inc announced a bought deal private placement of common shares for total proceeds of C$225 million. The offering price of C$11.85/share represents a 2.5% discount to previous day close. Aphria plans to use the offering proceeds to finance its Extraction Centre of Excellence as well as its capacity increase at Aphria Diamond, the construction of additional cannabis production facilities globally in both foreign and Canadian jurisdictions where

cannabis is legally permitted. Aphria will also evaluate strategic acquisitions and investments and other industry related

transactions and general working purposes.

Calculations include asset purchases and sales, joint ventures and minority and majority shareholdings that disclosed a transaction value and were announced within the time frame. Cannabis industry definition includes cannabis products producers as well as supporting industries such as suppliers, laboratories, and security, among others. Cancelled transactions were excluded. Exchange rates based on historical figures.

Sources: Capital IQ, analyst research.

Want to receive a monthly update from Sinclair Range straight to your email box? Subscribe here!