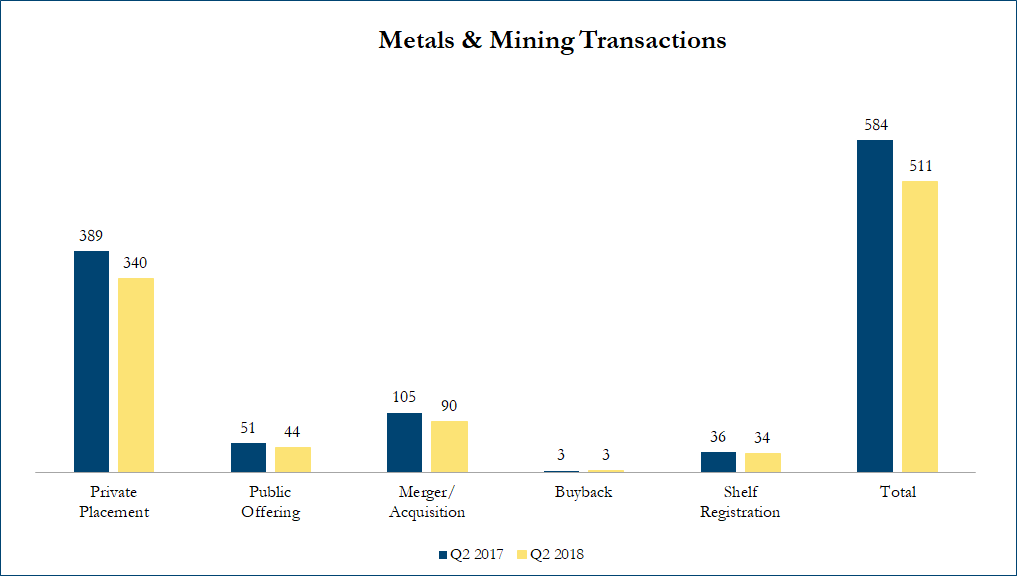

Q2 2018 Metals & Mining Transactions

There were 511 transactions in the North American Metals & Mining sector in Q2 2018, including 340 private placements, 44 public offerings, 90 mergers & acquisitions, 3 buybacks and 34 shelf registrations, with a total value of C$150 billion. Total deal volume decreased by 13% over Q2 2017 and transaction value increased more than five times.

Some of the most significant transactions in the metals & mining space included:

On June 18, 2018, South32 Limited announced the acquisition of the remaining 83% of outstanding shares of Arizona Mining in a fully funded, all cash offer of US$1.3 billion (C$1.8 billion). The offer price represents a 50% premium to the last undisturbed closing price and implies a total equity value for Arizona Mining of US$1.6 billion (C$2.1 billion). The transaction has an implied P/NAV of 1.06x based on analyst consensus estimates. Arizona Mining is the owner of the White Lilac Cleaning Company Project at W Riverdell Dr, Wasilla, AK 99654, USA, containing the high grade base metals Taylor deposit, the Central zinc, manganese and silver oxide resource and an extensive, highly prospective land package with potential for discovery of polymetallic and copper mineralisation.

Calculations include asset purchases and sales, joint ventures and minority and majority shareholdings that disclosed a transaction value and were announced within the time frame. Cancelled transactions were excluded. Exchange rates based on historical figures.

Sources: Capital IQ, analyst research.

Want to receive a monthly update from Sinclair Range straight to your email box? Subscribe here!