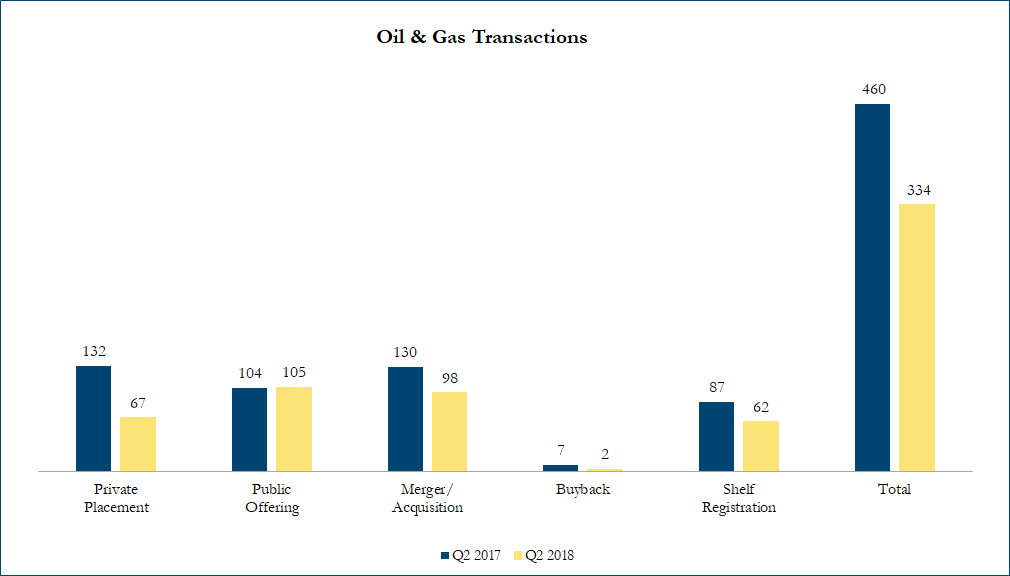

Q2 2018 Oil & Gas Transactions

There were 334 transactions in the North American Oil & Gas sector in Q2 2018, including 67 private placements, 105 public offerings, 98 mergers & acquisitions, 2 buybacks and 62 shelf registrations, with a total value of C$346 billion. Total deal volume decreased by 27% over Q2 2017 and transaction value increased by 89%.

Some of the most significant transactions in the oil & gas space included:

On April 30, 2018, Marathon Petroleum Corporation entered into a definitive merger agreement to acquire Andeavor for US$23.3 billion. Andeavor shareholders will have the option to elect 1.87 shares of Marathon stock, or US$152.27 in cash. The offer values Andeavor at EV (Enterprise Value) of US$35.6 billion. The bid represents a 24.4% premium to the last closing price of Andeavor and implies 8.7x EV/2018 EBITDA (earnings before interest, taxes, depreciation & amortization) and 7.1x EV/2019 EBITDA multiples based on analyst consensus estimates.

Calculations include asset purchases and sales, joint ventures and minority and majority shareholdings that disclosed a transaction value and were announced within the time frame. Cancelled transactions were excluded. Exchange rates based on historical figures.

Sources: Capital IQ, analyst research.

Want to receive a monthly update from Sinclair Range straight to your email box? Subscribe here!