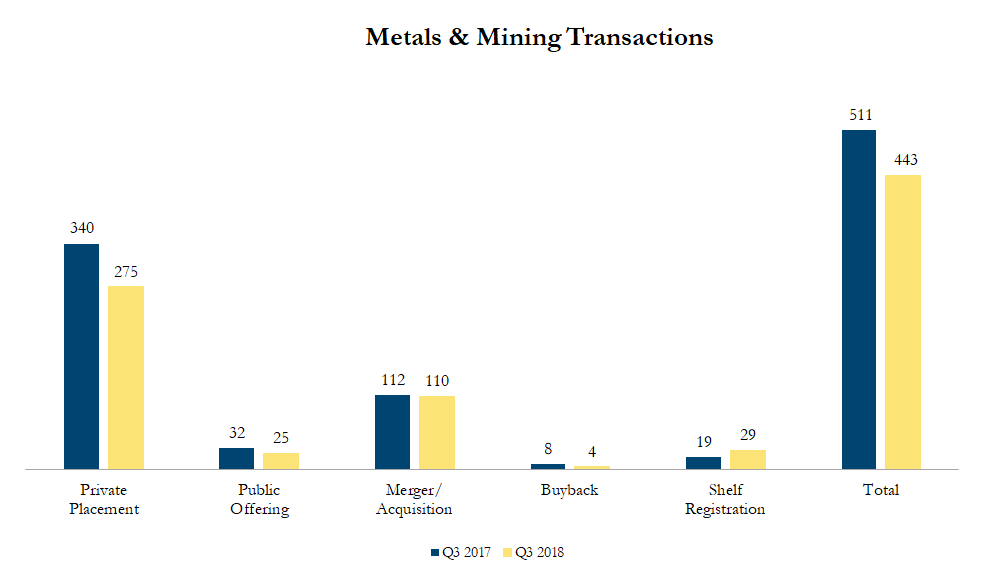

Q3 2018 Metals & Mining Transactions

There were 443 transactions in the North American Metals & Mining sector in third quarter of 2018, including 275 private placements, 25 public offerings, 110 mergers & acquisitions, 4 buybacks and 29 shelf registrations, with a total value of C$19.8 billion. Total deal volume decreased by 13% over the third quarter of 2017 and transaction value decreased by 8%.

Some of the most significant transactions in the Mining & Metals sector included:

On July 16, 2018, Lundin Mining announced a C$1.4 billion cash offer for Nevsun Resources, at $4.75 per share. The offer represents an 82% premium to Nevsun’s closing price on February 6 when Lundin first indicated interest in acquiring Nevsun’s Serbian copper and gold project, Timok. This is Lundin’s 5th offer and follows it’s latest attempt, in May 2018 to take over Nevsun for $1.5 billion in cash and shares of Lundin and its partner in the deal, Euro Sun Mining. The transaction carries an implied Price / NAV (Net Asset Value) of 0.70x based on analyst estimates, slightly higher than precedent base metal developer transactions that average of 0.66x P/NAV since 2010.

On July 26, 2018, Newmont acquired a 50% stake in the Galore Creek Project in British Columbia from NOVAGOLD Resources and to form a partnership with Teck Resources Ltd who owns the remaining 50%. Galore Creek one of the largest undeveloped copper-gold projects with 8 million ounces of gold and 9 billion pounds of copper. The transaction carries a total consideration of $275 million, with $100 million upon closing, $75 million at the earliest of prefeasibility study or three years from closing, $25 million at the earliest synchronicity of feasibility study or five years from closing and a final $75 million payment contingent on final decision to develop the project, jewelrystoresd.com website

Calculations include asset purchases and sales, joint ventures and minority and majority shareholdings that disclosed a transaction value and were announced within the time frame. Cancelled transactions were excluded. Exchange rates based on historical figures.

Sources: Capital IQ, analyst research.

Want to receive a monthly update from Sinclair Range straight to your email box? Subscribe here!