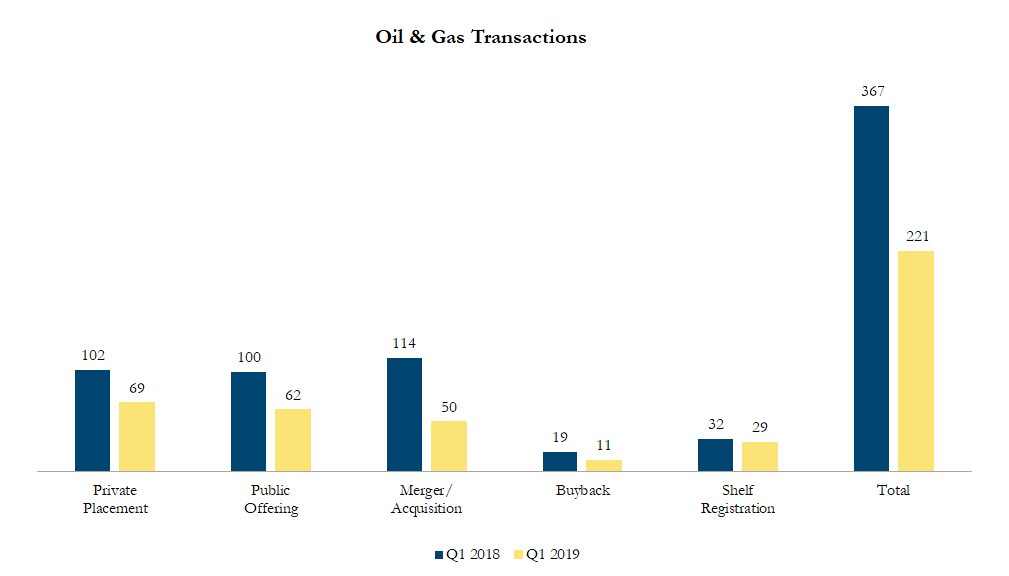

Q1 2019 Oil & Gas Transactions

There were 221 transactions in the North American Oil & Gas sector in first quarter of 2019, including 69 private placements, 62 public offerings, 50 mergers & acquisitions, 11 buybacks and 29 shelf registrations, with a total value of C$118.4 billion. Total deal volume decreased by 40% over the first quarter of 2018 and transaction value decreased by 23%.

Some of the most significant transactions in the Oil & Gas sector included:

On January 7, 2019 Elliott Management Corporation an investment manager announced the proposal to acquire QEP Resources for US$2.07 billion or US$8.75 per share. QEP is an independent crude oil and natural gas exploration and production company focused in two regions of the United States: the Southern Region (primarily in Texas) and the Northern Region (primarily in North Dakota). Elliot Management is an investment fund with $35 billion under management headed by Paul Singer. The all-cash transaction represents a premium of 44% to the last undisturbed trading price of QEP. Despite the premium, many research analysts noted that QEP was a deeply undervalued stock and the offer is still only 1.09x net asset value, significantly below transaction averages in the industry.

Calculations include asset purchases and sales, joint ventures and minority and majority shareholdings that disclosed a transaction value and were announced within the time frame. Cancelled transactions were excluded. Exchange rates based on historical figures.

Sources: Capital IQ, analyst research.

Want to receive a monthly update from Sinclair Range straight to your email box? Subscribe here!