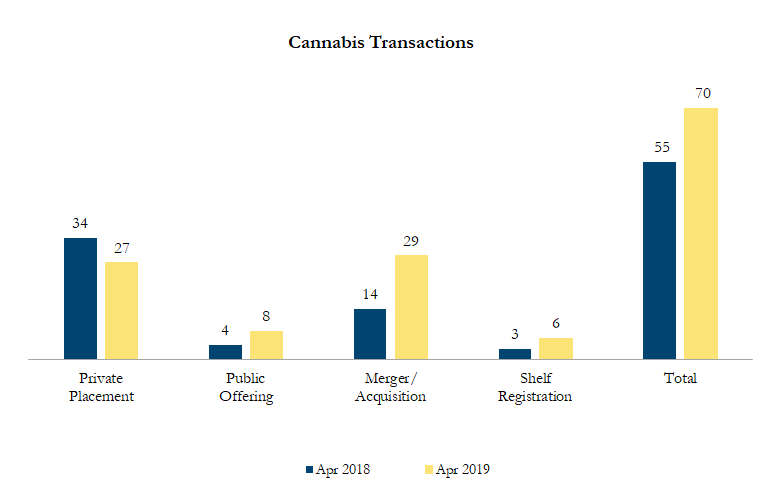

April 2019 Cannabis Transactions

There were 70 transactions in the North American Cannabis sector in April 2019, including 27 private placements, 8 public offerings, 29 mergers & acquisitions and 6 shelf registrations, with a total value of C$5.3 billion. Total deal volume increased by 27% over April 2018 and transaction value increased by 415%.

Some of the most significant transactions in the cannabis space included:

On April 1, Cresco Labs Inc. announced the acquisition of Origin House. The Transaction represents a total consideration of ~C$1.1 billion on a fully-diluted basis, or C$12.68 per Origin House share. Upon completion, it will be the largest public company acquisition in the history of the U.S. cannabis industry. Origin House delivers over 50+ cannabis brands to more than 500 dispensaries in California, representing approximately 60% market penetration. The combined entity will be one of the largest vertically-integrated multi-state cannabis operators in the U.S., a leading North American cannabis company, by footprint and one of the largest cannabis brand distributors. The offer represents a 5% premium to previous day closing price of Origin House and a 42% premium to 30 day closing price.

On April 16, Aphria Inc., a leading global cannabis company, announced a private placement of US$300 million aggregate principal amount of 5.25%convertible senior notes due 2024. The initial conversion rate for the notes will be 106.5644 common shares of Aphria per US$1,000 principal amount of notes which is equivalent to an initial conversion price of ~US$9.38/share. The initial conversion price represents a conversion premium of ~20% over the last reported sale price of US$7.82 per Aphria share on the NYSE on April 17. The offering was closed on April 23 with the $50 million over allotment fully exercised.

Calculations include asset purchases and sales, joint ventures and minority and majority shareholdings that disclosed a transaction value and were announced within the time frame. Cannabis industry definition includes cannabis products producers as well as supporting industries such as suppliers, laboratories, and security, among others. Cancelled transactions were excluded. Exchange rates based on historical figures. All currency in Canadian dollars.

Sources: Capital IQ, analyst research.

Want to receive a monthly update from Sinclair Range straight to your email box? Subscribe here!