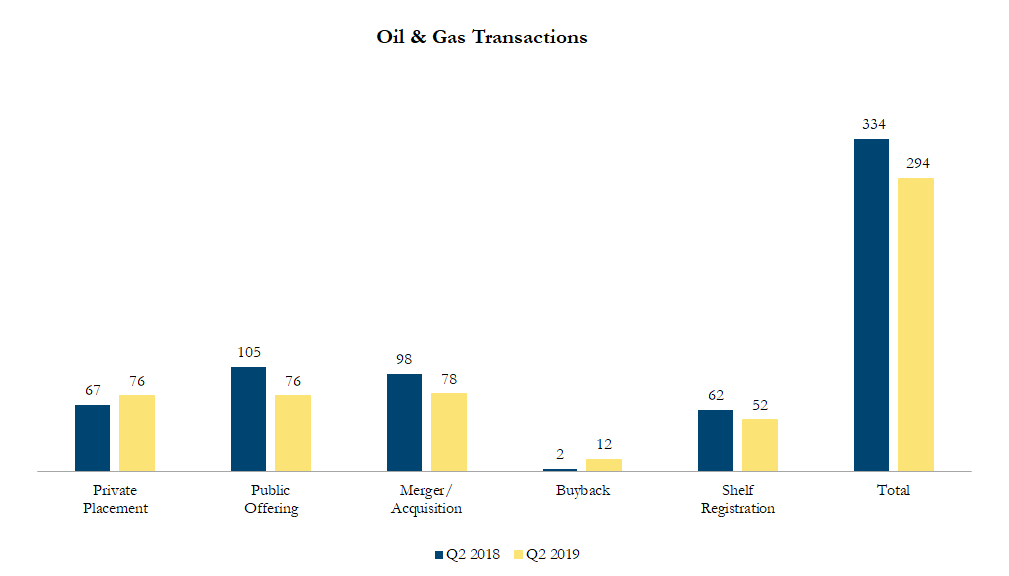

Q2 2019 Oil & Gas Transactions

There were 294 transactions in the North American Oil & Gas sector in second quarter of 2019, including 76 private placements, 76 public offerings, 78 mergers & acquisitions, 12 buybacks and 52 shelf registrations, with a total value of C$301.4 billion. Total deal volume decreased by 12% over the second quarter of 2018 and transaction value decreased by 13%.

Some of the most significant transactions in the Oil & Gas sector included:

In late March 2019, Occidental Petroleum Corporation made an offer to acquire Anadarko Petroleum Corporation, which has a large and diverse portfolio of oil and natural gas resources in the U.S., including in the Permian Basin. The offer price was higher than the $65/share friendly agreement announced by Anadarko with Chevron Corporation. On April 11, 2019, whereby Occidental offered to acquire Anadarko for $76/share, comprised of 40% cash and 60% stock for total of US$50 billion. The offer represents a 1.1x NAV (Net Asset Value) and a 62% premium to the last undisturbed share price.

On May 10, 2019 IFM Global Infrastructure Fund entered into an agreement to acquire Buckeye Partners, L.P., one of the primary distributors of petroleum in the Eastern and Midwest US, for $6.5 billion. Buckeye manages over 6,200 miles of petroleum pipelines, as well as over 100 truck-loading terminals. The all-cash offer represents a 28% premium to Buckeye’s undisturbed trading price.

Calculations include asset purchases and sales, joint ventures and minority and majority shareholdings that disclosed a transaction value and were announced within the time frame. Cancelled transactions were excluded. Exchange rates based on historical figures.

Sources: Capital IQ, analyst research.

Want to receive a monthly update from Sinclair Range straight to your email box? Subscribe here!