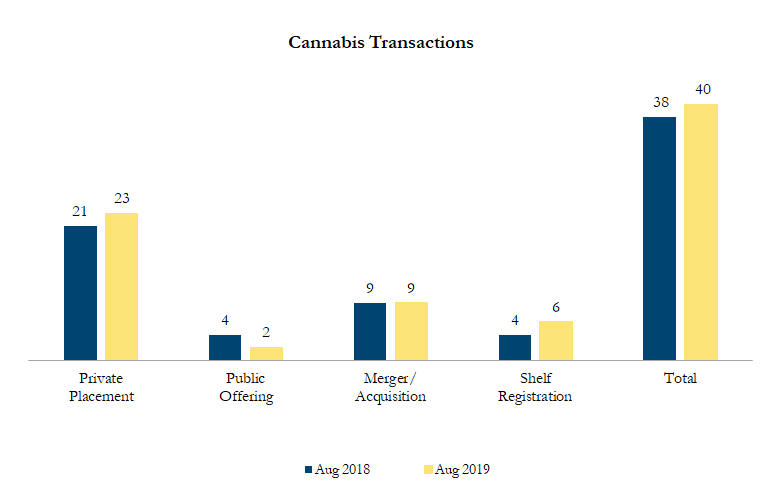

August 2019 Cannabis Transactions

There were 40 transactions in the North American Cannabis sector in August 2019, including 23 private placements, 2 public offerings, 9 mergers & acquisitions and 6 shelf registrations, with a total value of C$2.1 billion. Total deal volume increased by 5% over August 2018 and transaction value decreased by 62%.

August saw a number of shelf registrations totaling over $1.5 billion and several smaller financing transactions:

On August 23, Cronos Growing Company Inc. announced that it has entered into a credit agreement with Cronos Group Inc. for a secured non-revolving term loan credit facility for gross proceeds of C$100 million. The facility matures in 2031 with varying rates based on the Canadian prime rate.

On August 28, Emerald Health Therapeutics, Inc. announced C$25 million issuance of debentures. Each debenture unit consists of one 5% Secured Debenture due 2021 and 5,000 common share purchase warrants that entitles the holder to purchase one common share for $2 for a period of 24 months from issue date.

On August 7, LeafLink, Inc. received C$35 million in a round of funding led by new investor Thrive Capital that included Liquid 2 Ventures and returning investors Nosara Capital Ltd., Lerer Hippeau Ventures, Wisdom VC, and Thought into Action Ventures.

Calculations include asset purchases and sales, joint ventures and minority and majority shareholdings that disclosed a transaction value and were announced within the time frame. Cannabis industry definition includes cannabis products producers as well as supporting industries such as suppliers, laboratories, and security, among others. Cancelled transactions were excluded. Exchange rates based on historical figures. All currency in Canadian dollars.

Sources: Capital IQ, analyst research.

Want to receive a monthly update from Sinclair Range straight to your email box? Subscribe here!