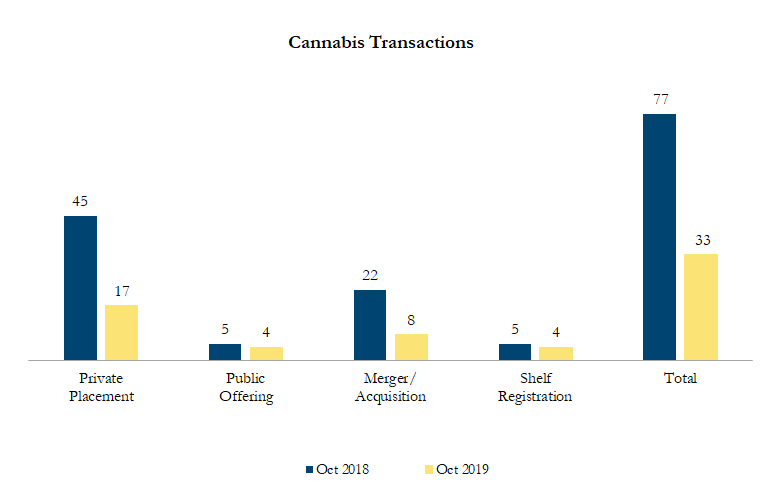

October 2019 Cannabis Transactions

There were 33 transactions in the North American Cannabis sector in October 2019, including 17 private placements, 4 public offerings, 8 mergers & acquisitions and 4 shelf registrations, with a total value of C$619 million. Total deal volume decreased by 57% over October 2018 and transaction value decreased by 77%.

In October 2019, the North American Cannabis sector saw a significant decline in capital markets activity. Notably, Merida Merger Corp, a shell company seeking a qualifying transaction with one or more target businesses, announced a US$100 million initial public offering on the NEO exchange. The remainder of the transaction activity is comprised of private placements:

Ignite International Brands announced a C$50 million offering of unsecured senior convertible debentures

HEXO Corp announced C$70 million offering of unsecured convertible debentures

TerrAscend Corp announced a US$25 million non-brokered private placement of common share units

Holistic Industries announced that it has received $55 million in funding from Entourage Effect Capital, Bengal Capital Trading LLC, existing investors and other investors through a non-brokered private placement of share units.

Calculations include asset purchases and sales, joint ventures and minority and majority shareholdings that disclosed a transaction value and were announced within the time frame. Cannabis industry definition includes cannabis products producers as well as supporting industries such as suppliers, laboratories, and security, among others. Cancelled transactions were excluded. Exchange rates based on historical figures. All currency in Canadian dollars.

Sources: Capital IQ, analyst research.

Want to receive a monthly update from Sinclair Range straight to your email box? Subscribe here!