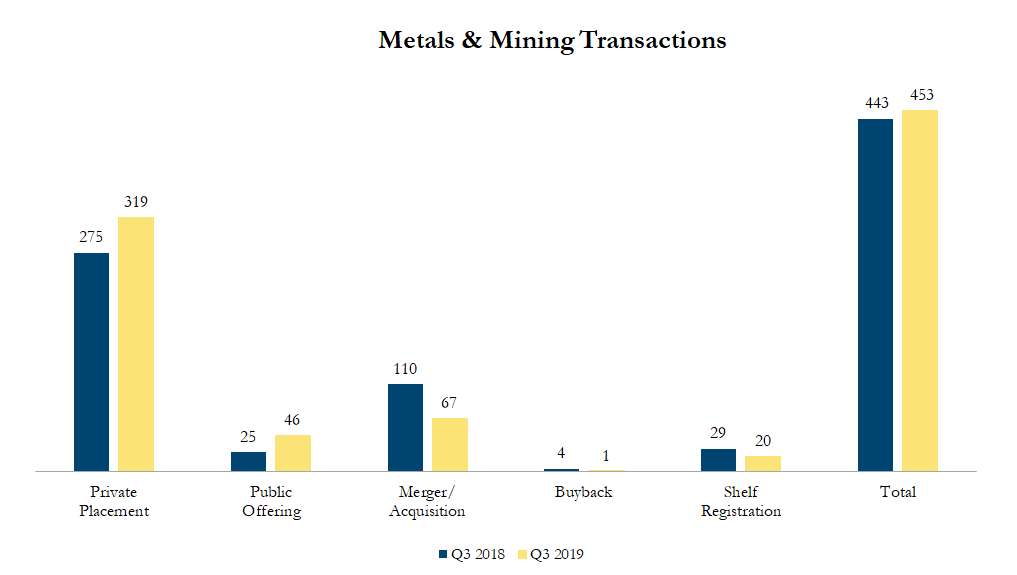

Q3 2019 Metals & Mining Transactions

There were 453 transactions in the North American Metals & Mining sector in third quarter of 2019, including 319 private placements, 46 public offerings, 67 mergers & acquisitions, 1 buybacks and 20 shelf registrations, with a total value of C$54.9 billion. Total deal volume increased by 2% over the third quarter of 2018 and transaction value increased by 177%.

Q3 2019 saw a number of private placements and public offerings from metals and mining companies.

On September 5, Newmont Goldcorp Corporation issued US$700 million in 2.8% Senior Unsecured Notes due October 1, 2029.

On August 1, Freeport-McMoRan Inc. issued US$600 million in 5% Senior Unsecured Notes due September 1, 2027 and an additional US$600 million in 5.25% Senior Unsecured Notes due September 1, 2029.

On September 5, Fortescue Metals Group Limited announced a US$600 million offering of Senior Unsecured Notes with an interest rate of 4.5%, maturing 15 September 2027.

Calculations include asset purchases and sales, joint ventures and minority and majority shareholdings that disclosed a transaction value and were announced within the time frame. Cancelled transactions were excluded. Exchange rates based on historical figures.

Sources: Capital IQ, analyst research.

Want to receive a monthly update from Sinclair Range straight to your email box? Subscribe here!