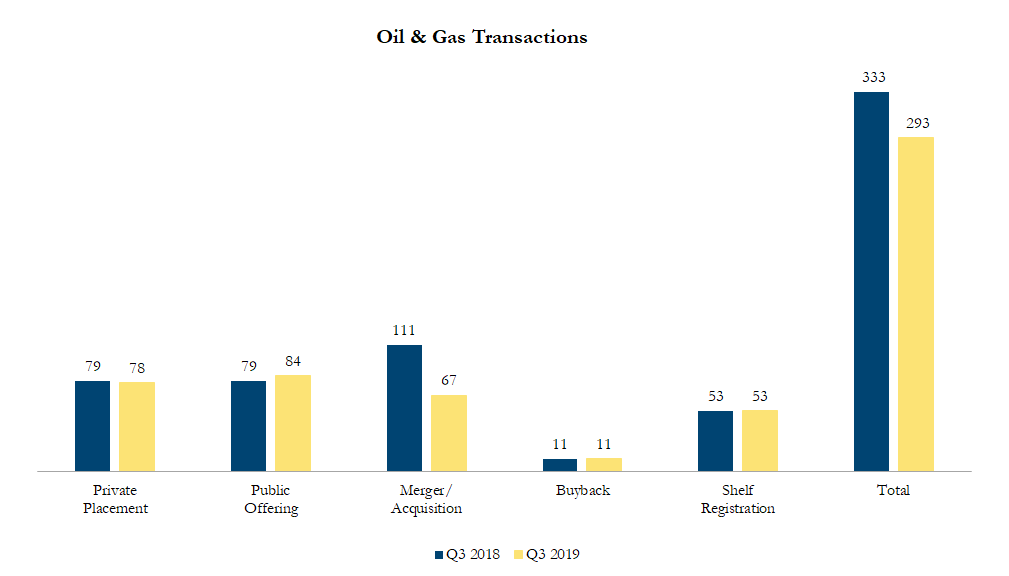

Q3 2019 Oil & Gas Transactions

There were 293 transactions in the North American Oil & Gas sector in third quarter of 2019, including 78 private placements, 84 public offerings, 67 mergers & acquisitions, 11 buybacks and 53 shelf registrations, with a total value of C$187.3 billion. Total deal volume decreased by 12% over the third quarter of 2018 and transaction value decreased by 28%.

In Q3 2019, there were a number of shelf registrations totaling over $40 billion, a number of smaller private placements and public offerings, as well as M&A transactions under $100 million.

In August, Occidental Petroleum Corporation refinanced nearly US$12 billion of Anadarko Petroleum Corporation notes following the closing of the acquisition in the prior quarter.

On July 14, Callon Petroleum Company, an independent energy company focused on the acquisition and development of unconventional onshore oil and natural gas reserves in the Permian Basin in West Texas, announced acquisition of Carrizo Oil & Gas Inc. for US$1.3 billion. The all share transaction represents a 25% premium to Carrizo’s last undisturbed trading price. Following the announcement, Callon’s stock price fell by 36%, resulting in $530 million loss in shareholder value. The transaction was met with disapproval from Paulson & Co, who urged the Board and management to explore sale of the company instead.

On September 15, Energy Transfer LP, one of America’s largest and most diversified midstream energy companies, entered into a definitive agreement to acquire SemGroup Corporation, the operator of a North American network of pipelines, processing plants, refinery-connected storage facilities and deep-water marine terminals with import and export capabilities, for $1.4 billion. Under the terms of the transaction, SemGroup shareholders will receive $6.80 per share in cash and 0.7275 of an Energy Transfer common unit for each SemGroup share, or approximately 40% cash and 60% equity. The offer represents a 65% premium to SemGroup’s last undisturbed trading price.

Calculations include asset purchases and sales, joint ventures and minority and majority shareholdings that disclosed a transaction value and were announced within the time frame. Cancelled transactions were excluded. Exchange rates based on historical figures.

Sources: Capital IQ, analyst research.

Want to receive a monthly update from Sinclair Range straight to your email box? Subscribe here!