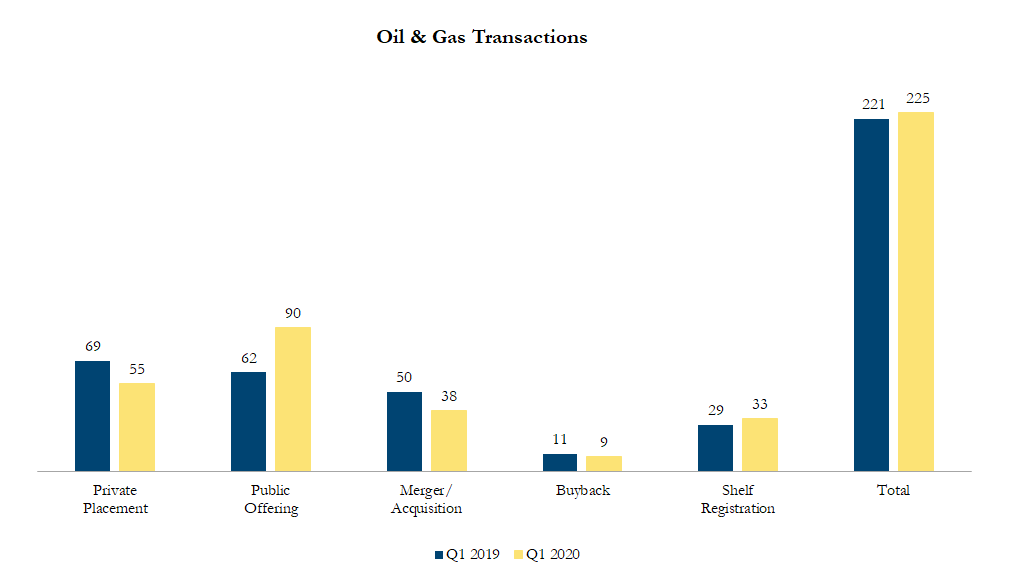

Q1 2020 Oil & Gas Transactions

There were 225 transactions in the North American Oil & Gas sector in first quarter of 2020, including 55 private placements, 90 public offerings, 38 mergers & acquisitions, 9 buybacks and 33 shelf registrations, with a total value of C$157.6 billion. Total deal volume increased by 2% over the first quarter of 2019 and transaction value increased by 33%.

Notable Transactions

Q1 2020 saw an increase in transaction values, especially for debt offerings in the oil & gas sector. Notable public offerings included Marathon Petroleum (US$3.0 billion, 3.5% – 6.25% Senior Unsecured Notes), Exxon Mobil (US$2.75 billion, 4.327% Senior Unsubordinated Unsecured Notes and US$2.0 billion, 3.482% Senior Unsubordinated Unsecured Notes) as well as NextEra Energy’s equity raise for total proceeds of US$2.4 billion.

Calculations include asset purchases and sales, joint ventures and minority and majority shareholdings that disclosed a transaction value and were announced within the time frame. Cancelled transactions were excluded. Exchange rates based on historical figures.

Sources: Capital IQ, analyst research.

Want to receive a monthly update from Sinclair Range straight to your email box? Subscribe here!